Part one : Budgeting

Are we going out of order? Yes, but this is important information, and I need to share it all.

If you have looked at my Author Stats posts, you have seen my budgeting spreadsheets, so part of this you’ve seen before, but I actually want to go into depth on how I organize it and why, but also what I haven’t been doing but should have been doing.

I recently had a conversation with a CPA about what in all I have, and in turn, found out so much more about what I’ve been lacking, but also had huge questions answered, and so…

Welcome to Step 15 : Budgeting and Taxes. Today, we’re going to be talking about the budgeting aspect – how to figure out your budget, etc, and then take notes on it. Next week, I’ll be posting the taxes information, including about LLCs.

Let’s do this.

STARTING BUDGET

I’ve talked previously about how much (or how little) I published my first book with, but the honest fact is… you need as much as you want to spend. And not anything more.

Do I 100% think that a newsletter is a big thing you need to start with, so in turn, you need a PO Box? Oh yeah, I’m still in that camp. Do I think that bookfunnel is the best way to send out your ARCs? Of course. Do I still swear by Atticus? Yup. And paying for someone else to do my book cover? I couldn’t have done this any other way.

But…

If you don’t want to deal with a newsletter yet, you don’t have to have it. You can send out epub files via email. You can format in free formatters. And cover design? Canva does have free options and there are free stock sites.

You can spend as much or as little as you want. You can spend hundreds on a cover. You can spend nothing on a cover. If you have the skill, you can even draw your own cover! The option is entirely up to you.

But this post isn’t really about the starting budget. Not really. I just wanted to throw my thoughts in there. No, this is about maintaining your business once you’ve started, and how to more or less keep it organized.

THE BASIC LIST

By now, you’ve probably all seen my fancy budgeting spreadsheet, but that’s not how I started, and it’s unrealistic to plan to start there either. If I was going to give any BIG recommendations…

Open a paypal account and pay 100% of everything through that paypal account, so that you have records all in one place connected to your publishing stuff. Or use a credit card, the same credit card, for publishing stuff and publishing stuff only.

(Note: treat the credit card like a charge card, friend, so you don’t get screwed over with interest)

By having a separate account of some sort that is just for publishing, it will be 100x easier to keep track of money out.

But you also probably need a basic list.

Mine started like this:

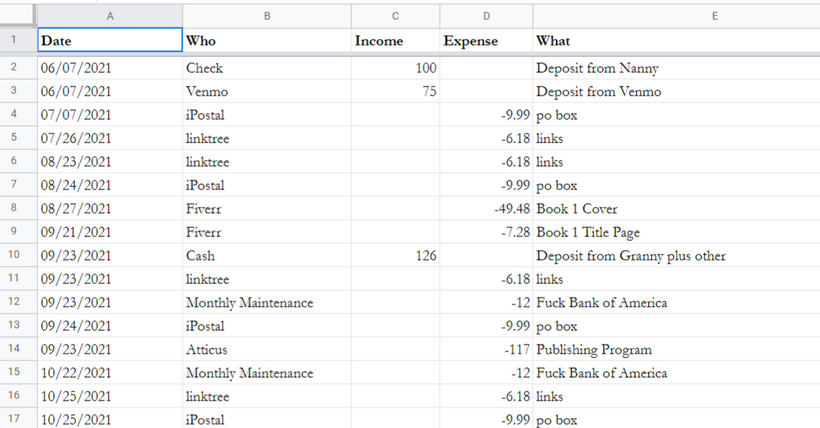

The date. Who it was. Income or Expense. What it was.

That’s it. That’s all you need. When, Who, What, Why.

If you’re asking yourself, is it really that simple? Yeah it is. And to be honest… this is all my CPA wants as well. She wants to know the month. She wants to know who I paid. She wants to know how much it was. And she wants it in a category.

That’s…….. it.

And honestly, you don’t need anything much more than this at the start, or even once you really get going, so long as you’re keeping track of things, but….

THE EXTENSIVE SPREADSHEET

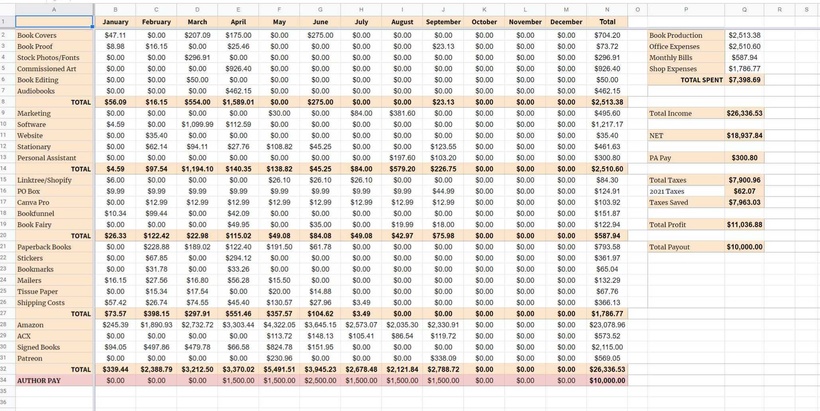

Everyone who sees my author stats posts always asks me where I got my budgeting spreadsheet from, and the honest answer is, I bought a layout on etsy, then butchered the hell out of it to meet my needs. I change it every 2-3 months, adding in new formulas or more categories or something else, but…

AGAIN. I HAVE BUTCHERED THE HELL OUT OF THIS.

But let me break it down for y’all on what in all I use this spreadsheet for and why I love it so much more than my simple basic list.

First and foremost, I like just looking at what is left of my budget. How much more do I have to spend? In particular, I use a business charge card for 99% of my purchases, which means that my bank account vs this spreadsheet is very different, because I’m charging these things that I won’t be paying until next month.

I also like that I can have references to things, like what month’s royalties things are.

Then we add in separating things out by categories that matter to me. We have my various bills that pop up at random vs things for my shop vs monthly things I pay regularly. I can guesstimate how much my payout will be from Amazon months ahead, based on what the royalties estimator says right now. I can put notes at the bottom for things I want to buy or things I’m saving up for.

And of course, we have some of the formulas, which I’ll discuss below.

DO YOU NEED TO HAVE THIS BIG EXTENSIVE THING? NO YOU DO NOT. But I like it.

And then there’s this graphic, which honestly, is my favorite part. I can compare and add up all of the different things. I have everything assigned to categories. I can look across and see what I’ve spent too much on, what I haven’t. I can look at my different expenses. It’s all right here, easy to grasp.

And when my CPA asked me for the basics – total income vs total I have saved for taxes vs total I’ve paid myself etc… I had it right here, ready to tell her.

Again, DO YOU NEED A BIG EXPENSIVE SHEET LIKE THIS? NO YOU DO NOT.

But I do highly recommend it.

GOOGLE SHEETS FORMULAS

Really quick, before I move on, let’s talk formulas y’all will probably need if you have spreadsheets like this. Like, just basic ones that I think are important.

Adding a set of column together: =SUM(N28:N31)

Adding multiple totals from different spots: =SUM(C22,G22,K22)

Subtracting one column from another: =MINUS(Q9,Q6)

Multiplying money made by tax holdout: =MULTIPLY(N32,30%)

Linking an amount from one sheet to the next: =’Aug 22′!B7

Adding an amount from one sheet to a number on another sheet for a new number: =SUM(‘Aug 22’!M15,M12)

PLEASE NOTE THESE ARE NOT EVERYTHING. Obviously, you would grab your own little number letter thingies, but these are some basic formulas that I’ve added in to keep myself straight!

KEEPING TRACK OF WHEN YOU ARE PAID WHERE

If you are already published, you already know this, but if you’re not, welcome to the stupidest thing ever… it takes different platforms different amounts of time to pay you. What I mean is…

ACX : Listened to in August, Paid end of September/start of October

KDP : Read in August, Paid end of October

Sometimes, I do my sheets for the month, and ACX hasn’t paid me yet, which means it’s now on the next month, which is a huge pain. A huge freaking pain. And of course, Amazon numbers means it can take maybe 90 days in total to be paid for your work. It’s… annoying.

But listen, it doesn’t matter what day you actually earned that money on the royalty tracker. All that matters is when you actually have the money in your bank account.

This means…

If, for whatever god forsaken reason, ACX is slow in December… if they don’t pay me until January, then what they paid me for November listening doesn’t go on my 2021 taxes.

This is why…

The little bubble spot on each monthly sheet? I keep track of what month I’m being paid for, because you’re also going to need to keep track of the payouts etc (and there’s 12 of them woo) for your finances next year. And on my little basic list, I make a note, in the category spot, of which month I’m being paid for.

KEEP TRACK OF IT.

And when you eventually print it all off, write in big capital letters what month the royalty is for and what day they were actually paid.

You’ll thank yourself later.

With all of that said…

PART TWO : TAX PREP

Alright. Let’s talk taxes.

But first, just to clear the air. I am not a CPA. I am not an accountant. I am an idiot. I am not a numbers girly. I am a panic and over prepare because otherwise my anxiety will not rest girly. I am a do the ultimate extra at the very last minute to the point that I’ve done 10x more than I needed to and yet still somehow fuck it up girly.

Okay.

I had a very long conversation with my now CPA a few weeks ago where we discussed so many things. I talked about all of the records I’ve been keeping, explaining that some of this was because I knew I would need it for taxes, some of it for my anxiety, etc. She answered questions about LLCs and tax withholdings. We talked about filing taxes for next year and setting myself up better for the following year.

This is what I learned.

RECORDS – MONEY IN

You need to be able to show where your money came from for the year. Listen to me again – FOR. THE. YEAR. It doesn’t matter when you earned that money – it matters when that money hit your bank account.

So if you didn’t make any money in 2021, because your book came out in December… you don’t file for 2021 (for the bookish stuff).

You with me?

You need to show how you earned money. This means… patreon content. This means… signed books. This means… Amazon payout and ACX payout.

Now, the great thing is, most of this is all saved and in monthly statements. Depending on how you do your signed books, this might be a lot more work than other things, but this is why I recommend a shop or a paypal invoice, so there are records.

You will need proof of what you were paid for and when… but these only need to be digital files. You can just download them all at the end of the year, etc. I personally like to do this quarterly so I stay on top of it.

Most likely, your cpa won’t actually need those files, but you yourself need to have it just in case you are audited.

What your CPA will need is some sort of spreadsheet showing those numbers. Month, what platform it was, and how much.

Put it in a spreadsheet. Keep it organized.

Again, do it regularly. Don’t get behind, because that’s how you get overwhelmed.

RECORDS – MONEY OUT

Alright, this one is a bit more fickle.

Now, I’m sure you’ve all heard people say “that’s a tax write off” or something similar… and now listen. I know you girlies like to tustle, but I’m not fighting on this one. I’m telling you like it is from the CPA.

Tax write offs don’t work the way you think, and what you think qualifies doesn’t matter – what matters is what the IRS thinks.

That stated, that doesn’t mean you shouldn’t keep records of what you spend your money on when it comes to your business.

As always, credit card and online purchases are the easiest to prove, because there are invoices. I can obviously prove how much money I spent on author copies this year because I have credit card statements and my amazon invoices.

Big purchases will most likely count…. for example, my new laptop will count!

But all of my pen purchases? Let’s be real… probably not.

BUT. YOU STILL NEED TO KEEP RECORDS OF WHAT YOU ARE SPENDING YOUR MONEY ON WHEN IT COMES TO THE BUSINESS.

Just know that not everything is a tax write off.

(after I find out what purchases from this year are tax write offs, I will 100% come back and let y’all know, btw)

HOLD OUT 30%

So I don’t know if y’all have heard this before, but it was repeated to me multiple times, so I just stuck with it, and recommended it to others. So. Here’s why you hold out 30%…

As a sole (or llc), you need to pay taxes for yourself. For your sole. That’s an automatic 15.3%, there is no write offs etc, that’s just how it is. You have to pay 15.3% of whatever you earned. Doesn’t matter if you’re in the red. It’s 15.3%.

FROM THERE, it’s based on your tax bracket for what else you have to pay, plus your write offs, how much you’ve spent, etc etc. 15% is a good coverage. You shouldn’t pay more than that. You honestly shouldn’t be paying that, even. But, it keeps you covered, just in case.

Saving 30% won’t hurt you, and worst case scenario, after you pay your taxes… you have extra money for the year to spend on covers or whatever else.

LLCs

Alright. Lots of people have asked me if I started an LLC. And the answer has been… no. I couldn’t afford it. I didn’t have time. Etc.

Now for 99% of things, you don’t really need an LLC… You’re still going to be taxed as sole. You can’t separate from that. It’s small business.

But…

It doesn’t hurt to have it. To have that business name. To have the formality. Particularly because, if for some crazy reason, you suddenly go viral… you can ask the IRS to tax you as an…

S-Corps

Now, this is a whole other legal mumbo jumbo thing. This is for only if you’re making more than 50k a year. I’m not there. I’m not in that bracket. But.

S-Corps can get huge tax breaks and write offs. You can give yourself benefits. It’s huge. It’s great.

If you’re looking at this, you’re probably not going to need to be an S-Corp, but you might need the ability to be taxed as one, which is why you need to have an LLC.

So, make sure you have your LLC set up before the end of year, so that next year, you have a little coverage. I’m working on that now.

BANK ACCOUNTS

Alright. Let’s just… take a minute.

Look, do you need a business bank account? Yeah, kind of. Once you have an LLC, you do. You need one. And the same with a credit card. You need a business credit or charge card. And you need to rack up those points. And…

These are all things you need to do, but they take time and effort. So in the meantime…

Have an extra bank account. A separate one. This way, it’s separate for your taxes, and not all intermingled. It will make things easier.

That stated…

FILING YOUR TAXES

At the end of the day… you still have to file it in with your regular taxes. Like… this is all part of your income etc. And maybe it’s not really a big deal. You file solo or whatever. Well, for me, this means filing with my husband. So like… am I saving plenty for taxes? Yeah, but like… everything is muddled together. You can’t just file the business unless you file alone but like it’s not for your business it’s for you and everything.

Tax season is stressful, but try to relax. It’s going to be okay. Lots of people do it.

I’ll cry about it later.

Please Note: This post was originally published and share on Elle’s Authoring Chaos Patreon on 3 October and 10 October 2022.